The 30-year fixed-rate mortgage reversed course this week, rising to an average of 3.56%. Despite the uptick, this is the first time that the 30-year fixed-rate mortgage has been under 3.6% for more than four consecutive weeks since the fourth quarter of 2016, Freddie Mac reports.

“Pipeline purchase demand continues to improve heading into the late fall with purchase mortgage applications up 9 percent from a year ago,” says Sam Khater, Freddie Mac’s chief economist. “The improved demand reflects the still healthy underlying consumer economic fundamentals, such as a low unemployment rate, solid wage growth, and low mortgage rates. While there has been a material weakness in manufacturing and consistent trade uncertainty, so far, the American consumer has proved to be resilient with solid home purchase demand.”

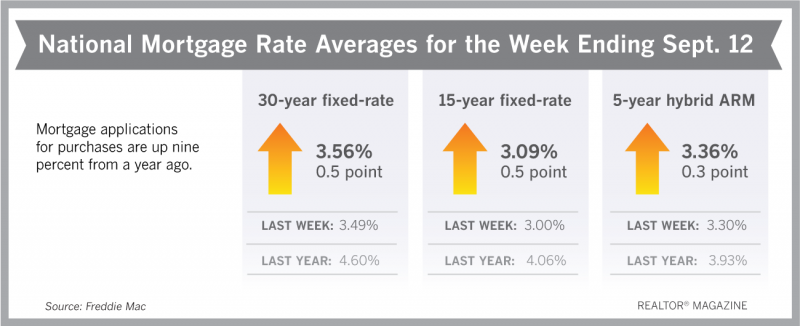

Freddie Mac reports the following national averages with mortgage rates for the week ending Sept. 12:

- 30-year fixed-rate mortgages: averaged 3.56%, with an average 0.5 point, rising from last week’s 3.49% average. A year ago, 30-year rates averaged 4.6%.

- 15-year fixed-rate mortgages: averaged 3.09%, with an average 0.5 point, rising from last week’s 3% average. A year ago, 15-year rates averaged 4.06%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.36%, with an average 0.3 point, rising from last week’s 3.3% average. Last year at this time, 5-year ARMs averaged 3.93%.

Source: Freddie Mac