Borrowing costs moved lower this week as the 30-year fixed-rate mortgage averaged 3.6%, Freddie Mac reports. Rates are at the lowest levels in three months and about a quarter-point above all-time lows. “The very low rate environment has clearly had an impact on the housing market, as both new construction and home sales have surged in response to the decline in rates, the rebound in the economy, and improving financial market sentiment,” says Freddie Mac Chief Economist Sam Khater.

The National Association of REALTORS® reported this week that existing-home sales increased 3.6% in December and were up 11% from a year ago.

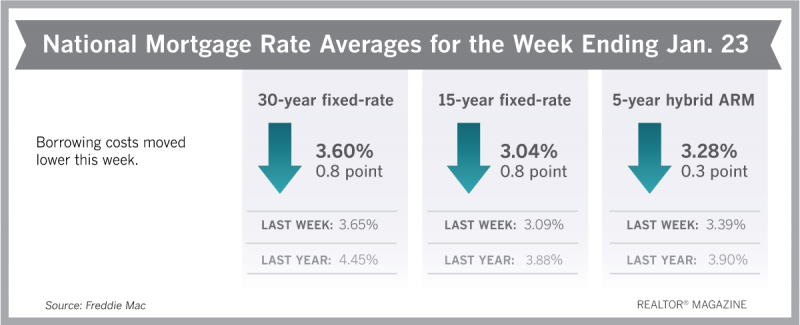

Freddie Mac reported the following national averages with mortgage rates for the week ending Jan. 23:

- 30-year fixed-rate mortgages: averaged 3.6%, with an average 0.8 point, falling from last week’s 3.65% average. Last year at this time, 30-year rates averaged 4.45%.

- 15-year fixed-rate mortgages: averaged 3.04%, with an average 0.8 point, dropping from last week’s 3.09% average. A year ago, 15-year rates averaged 3.88%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.28%, with an average 0.3 point, dropping from a 3.39% average. A year ago, 5-year ARMs averaged 3.9%.

Source: Freddie Mac